Family holdings

A response to specific needs

Ultra-high net worth individuals and family holdings have increasingly sophisticated needs which are constantly evolving. They are concerned with an array of themes including philanthropy and sustainable development.

Indosuez group and Crédit Agricole CIB entities are solid institutions with the expertise required to integrate these trends and meet this clientele’s expectations.

A dedicated team

To support ultra-high net worth individuals and family holdings worldwide, Indosuez and Crédit Agricole CIB teamed up in 2020 by creating the "Private Investment Banking" team.

Combining the global expertise of senior investment bankers and private bankers, the Private Investment Banking team strives to build lasting partnerships with the family businesses it supports in more than 45 countries around the world.

With due regard for the laws and regulations applicable to these various countries, it provides them with solutions that target their specific requirements expressed.

A distinctive approach

Private Investment Banking aims to:

- Better grasp the needs of decision-makers and family members through a joint commercial approach ;

- Provide a global approach relying on Crédit Agricole CIB's and Indosuez's bankers network with a dedicated entry point in the different countries of operation ;

- Deliver a comprehensive range of products and services leveraging the set-up of Crédit Agricole CIB, Indosuez and other Crédit Agricole group entities.

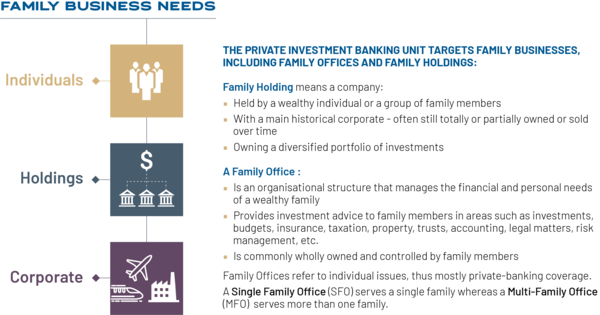

In order to meet the specific needs of family businesses, from individual shareholders to family holdings:

The Private Investment Banking team also draws from Crédit Agricole group’s differentiating strengths:

- Long term strategy with stable and steady governance

- Large and solid balance sheet

- Above average rating

- Vast financing capacities

Its key partners are: